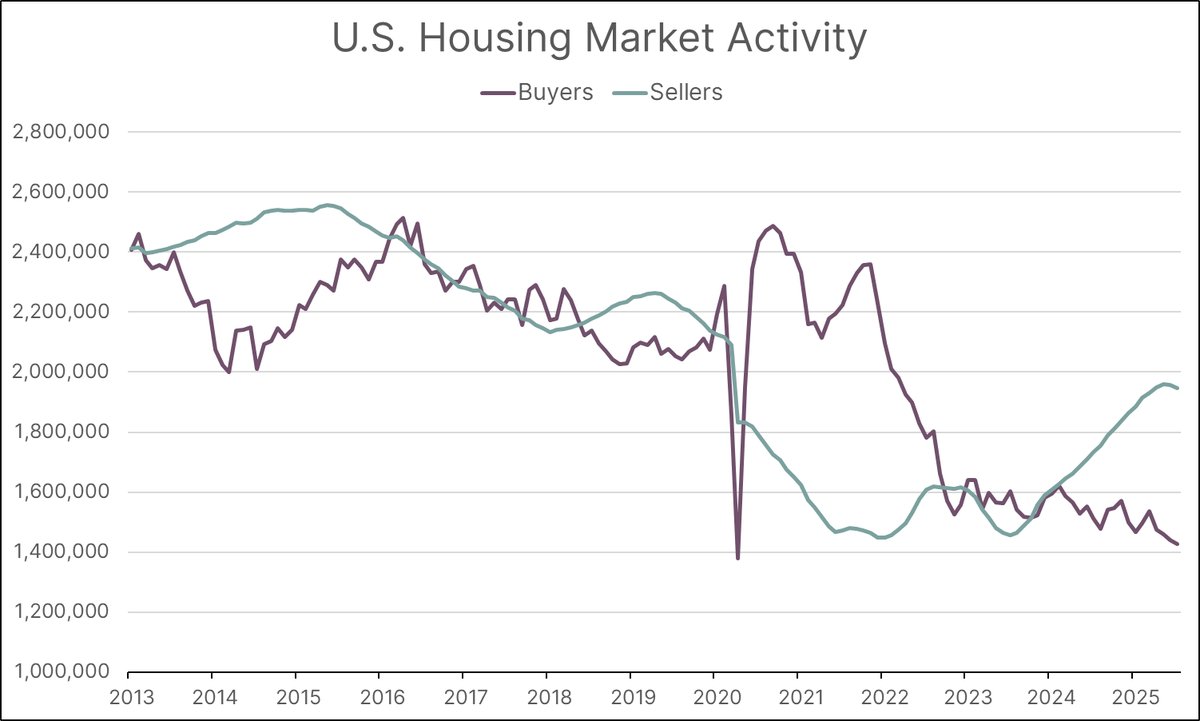

The ratio of home buyers to home sellers has never been lower.

As of July 2025, the ratio stands at 0.73, the lowest reading on record since tracking began in 2013. In real terms, this translates to 518,000 fewer buyers relative to sellers. We’ve decided to take this opportunity to explain some of the dynamics behind this imbalance.

The Mortgage Rate Shock

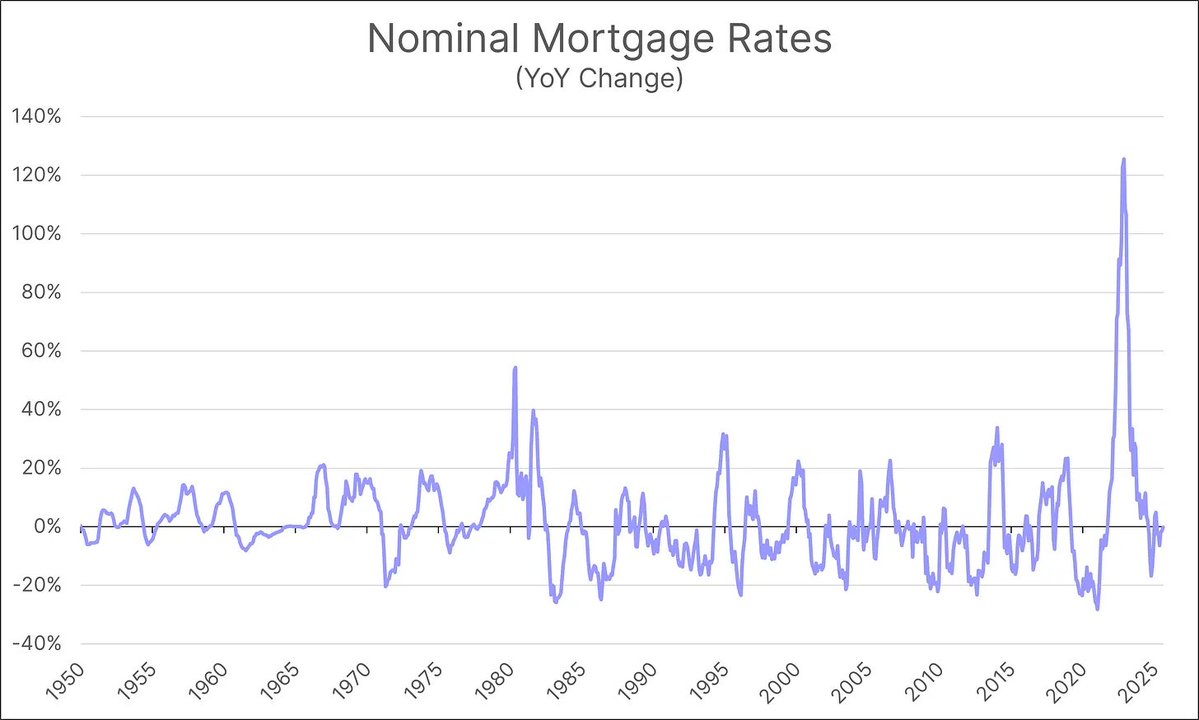

The first and most important factor to understand is the profound shift in mortgage rates, which directly affects housing affordability.

When the Federal Reserve began raising rates to combat post-pandemic inflation, mortgage rates rose in tandem. What’s crucial to recognize about mortgage rates—and really interest rates in general—is that the percent change often tells a more meaningful story than the percentage point change.

For example, when mortgage rates rose from 3% to 7%, one way to describe it is as a 4-percentage-point increase. That phrasing is accurate, and it has happened before. But it doesn’t fully capture the magnitude of the change.

In percentage terms, rates more than doubled—a relative increase that is historically unprecedented. This surge has caused affordability to collapse, pushing many would-be buyers out of the market altogether.

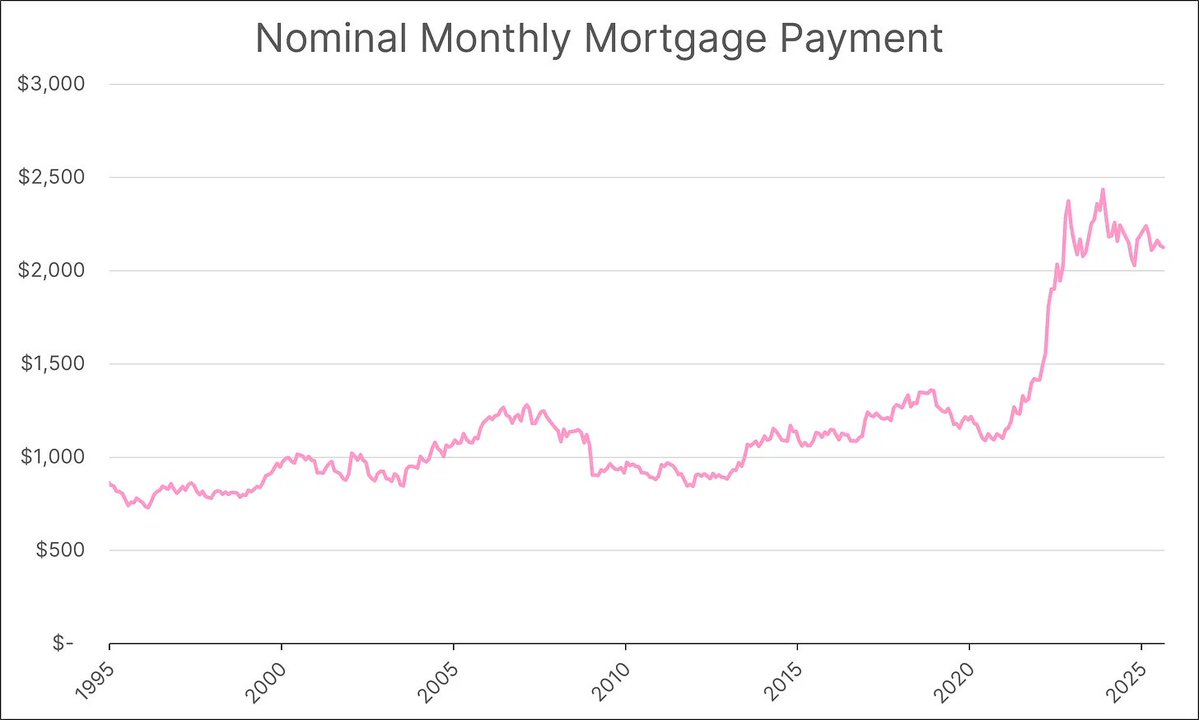

The Payment Burden

Another way to view the impact is through monthly mortgage payments. It’s important to note that the accompanying graph does not account for property taxes and insurance.

Even so, over the past five years, the nominal monthly mortgage payment has risen by 94.4%. Very few households have seen their incomes grow anywhere near that pace.

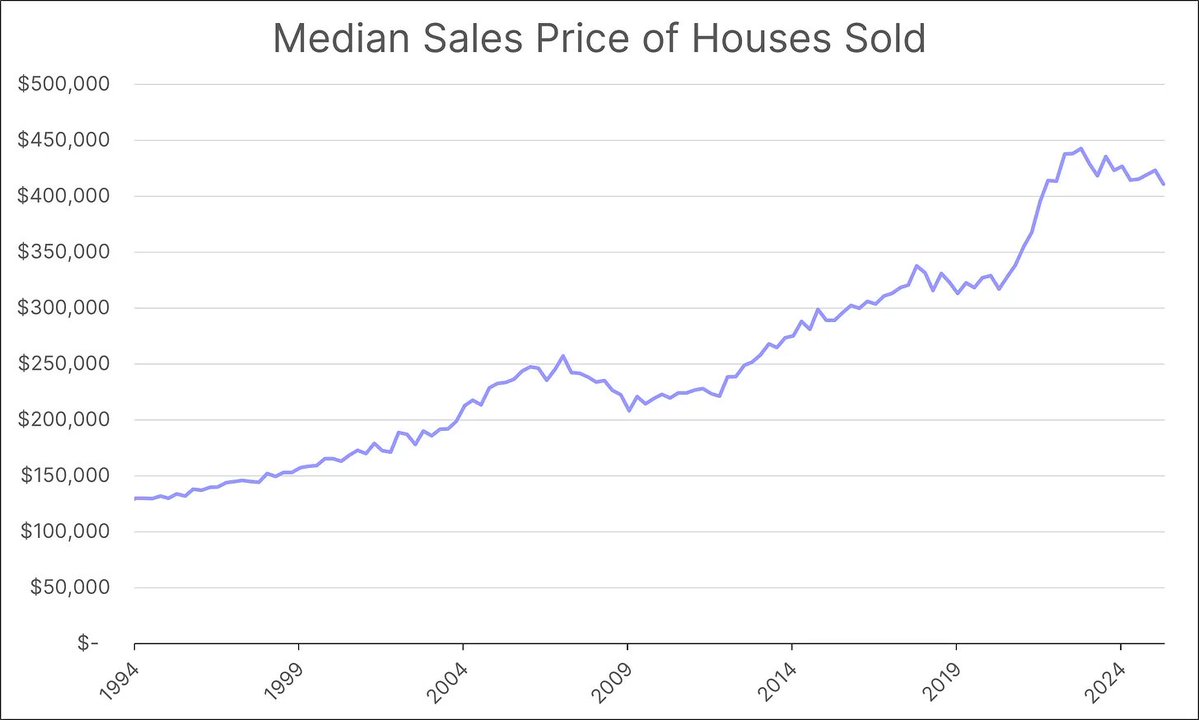

Rising Home Valuations

Mortgage rates are not the only culprit in this affordability crisis. Home valuations have also surged. The median sales price of houses sold increased from $317,100 to $410,800 over the past five years—a 29.5% jump.

Taken together, higher prices and higher borrowing costs have priced out millions of Americans.

Insurance Adds to the Pressure

Insurance costs add yet another layer of pressure. A report from the Consumer Federation of America found that homeowners have faced a 24% increase in premiums over just the past three years.

In summary, every variable that feeds into housing affordability—mortgage rates, home prices, property taxes, and insurance—has moved higher.

The Four Levers of Affordability

There are four levers that can, in theory, improve affordability:

- Mortgage rates - Tied to Federal Reserve policy and bond market expectations

- Home valuations - The only lever sellers can directly control

- Insurance premiums - Unlikely to reverse as climate-related risks mount

- Property taxes - Local governments are unlikely to cut rates

Of these, the two most influential are mortgage rates and home valuations. Mortgage rates, in turn, are closely tied to the 10-year Treasury yield and therefore to Federal Reserve policy and bond market expectations.

Insurance premiums are unlikely to reverse course, and the long-term trend suggests they will continue rising as climate-related risks mount. Local governments are similarly unlikely to cut property tax rates.

Price Reductions Spreading

In practical terms, that leaves only home valuations as the lever sellers themselves can pull—and we are beginning to see price reductions spread across the country.

Of course, real estate remains deeply regional. Some areas—Cape Coral, Florida, or Sun City, Arizona, for instance—are likely to see deeper price cuts than others.

Looking Ahead

Looking ahead, the trajectory of the housing market will depend heavily on Federal Reserve policy and the bond market’s reaction to it. Fluctuations in mortgage rates will play a decisive role in how far sellers must reduce asking prices to reignite demand.