Gold is not drifting higher for no reason. Each move reflects cracks in the system: the Fed’s uneasy balancing act, repeated shutdown threats, a debt burden that cannot be managed with current revenues, and bond markets that are beginning to push back. Gold has become the scoreboard for all of it.

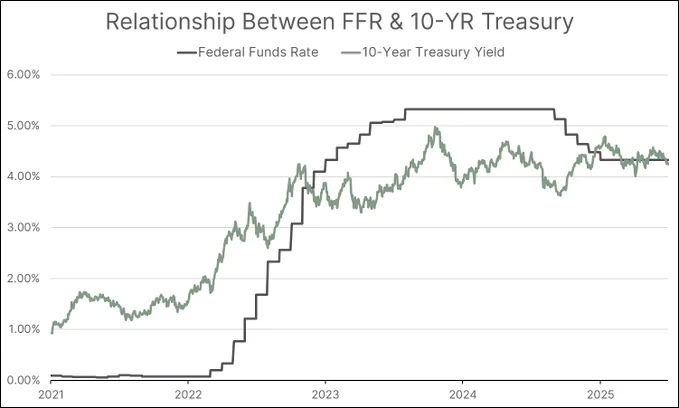

Fed Cuts and Market Doubt

Rate cuts usually send investors into stocks, not gold. This time is different. Equities are not surging because long-term yields have not followed the Fed lower. In fact, yields have risen. That shows bond markets are less concerned about growth and more concerned about whether the government can actually manage its debt.

Gold benefits from that skepticism. It does not rely on coupon payments or fiscal discipline. When rate cuts occur while debt levels rise, investors turn to an asset that is outside the system and cannot be printed.

Shutdown Dysfunction

Every fall brings the same fight in Washington over spending bills and policy riders. Shutdowns end eventually, but the repetition chips away at confidence. If lawmakers cannot even pass basic funding, how will they address deficits that add trillions every year?

Gold rises on that loss of faith. The shutdowns are not the real story. The message they send about long-term governance is.

Inflation Edging Higher

Inflation progress has stalled near 3 percent and is moving higher again. Job growth, meanwhile, was revised sharply lower by nearly one million positions. That mix of sticky inflation and weaker employment is the classic stagflation warning.

For bonds and equities, stagflation is damaging. For gold, it is supportive. Even the possibility of stagflation is enough for investors to increase exposure.

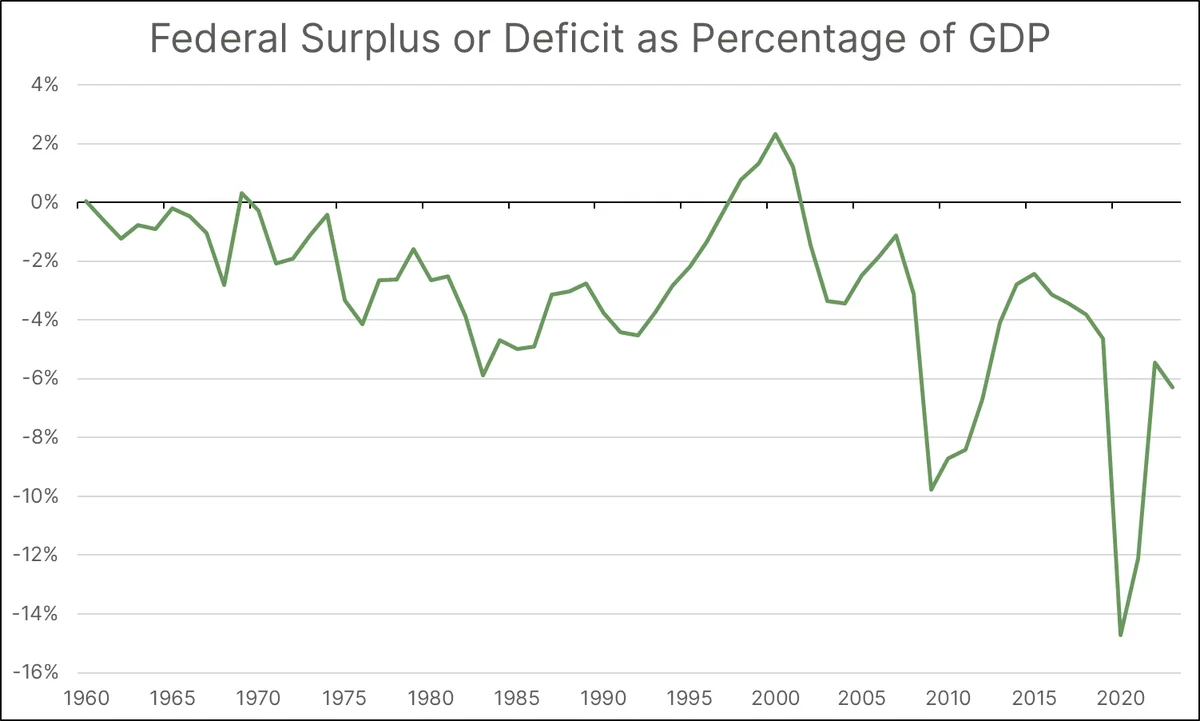

Debt That Cannot Be Ignored

Federal debt now stands at $37.4 trillion, while annual revenue is $4.9 trillion. On top of that, the federal deficit is already at a level that is concerning. A recession would make this worse. Tax receipts would fall, spending would increase, and the ratio would climb further.

Investors know the math. Gold is moving because the fiscal picture leaves no margin for error.

Political Pressure on the Fed

Trump’s attacks on Jerome Powell recall Nixon’s pressure on Arthur Burns in the 1970s. That period ended with runaway inflation and Paul Volcker pushing rates to 20 percent to restore credibility.

The concern is that central bank independence could weaken again. Once credibility goes, the dollar weakens as well, and gold strengthens.

Why Gold Is Moving

Gold is rising because confidence is draining from the institutions that are supposed to hold the system together. Rate cuts are not translating into lower yields, shutdowns have become routine, inflation is not under control, debt has no credible path downward, and the Fed is under political attack.

Unlike bonds, gold does not rely on repayment. Unlike equities, it does not rely on growth. It rises when investors stop believing that policymakers can manage the system.

That is why gold is moving, and it may not be finished.