Housing affordability is at multi-decade lows, and many people believe this is due to a paltry supply of homes.

That’s a flawed belief—and by the end of this write-up, we think you’ll understand why.

The Mathematics of Mortgage Rates

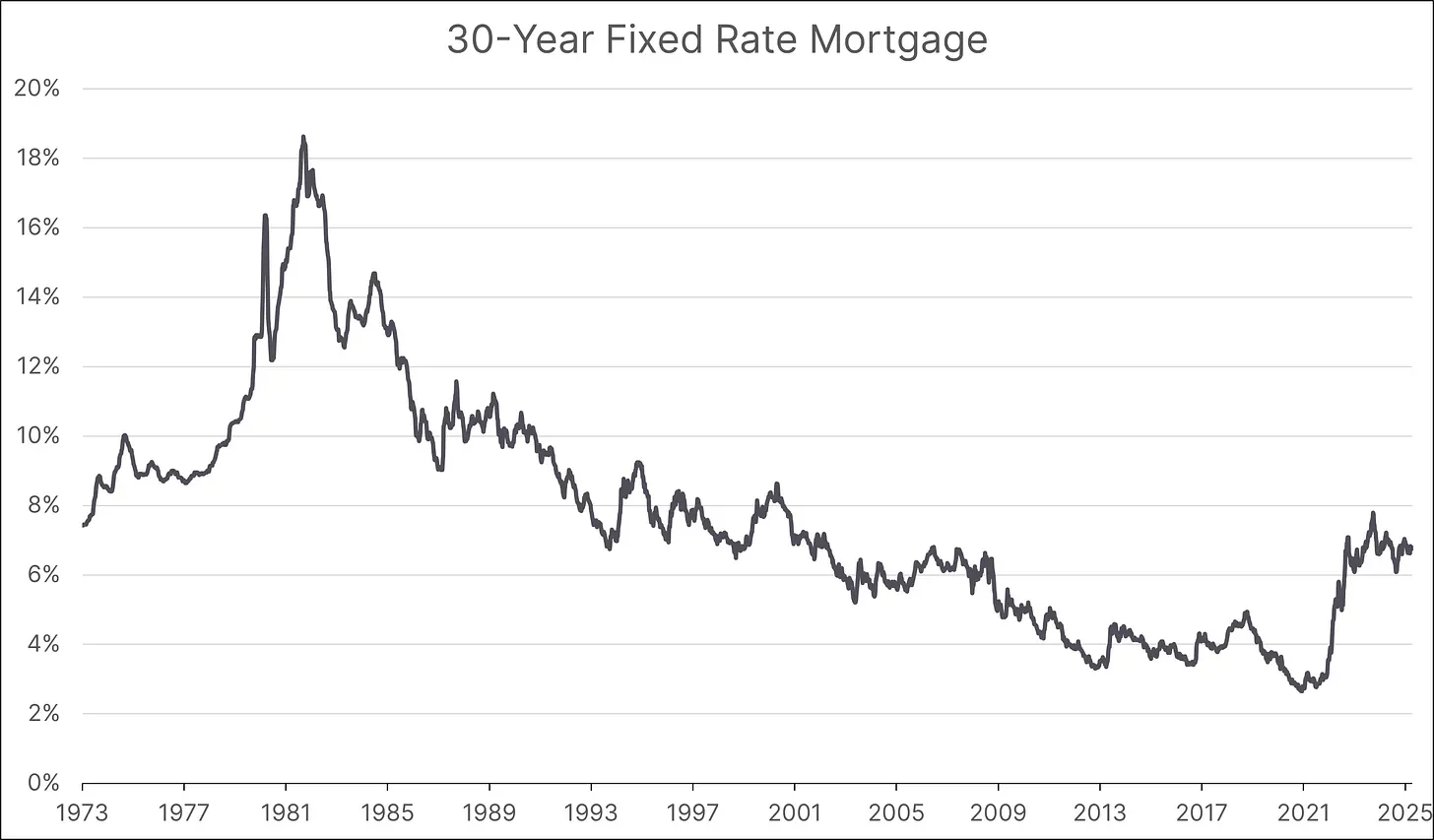

Understanding the chart below is key to understanding what many home sellers don’t: mortgage rates have dramatically changed how homes are valued in the United States. To grasp why this matters, let’s break down how mortgage rates influence affordability.

First, regardless of the principal balance, mortgage rates affect affordability in the same way—in percentage terms.

Let’s walk through an example. Consider a mortgage rate increase from 4% to 6%. We’ll look at how this affects two different loan sizes: $300,000 and $600,000. For simplicity, we’re ignoring other costs that go into a monthly mortgage payment—like insurance and property taxes.

On a $300,000 loan, the monthly payment jumps from $1,432 to $1,799—an increase of $366.

On a $600,000 loan, the monthly payment rises from $2,864 to $3,597—an increase of $733.

Despite the difference in dollar amounts, the percentage increase in both cases is the same: 25.6%.

Why? Because the mortgage rate increased by 50%. That’s the only variable that changed—yet the monthly payment rose sharply.

Here’s where it gets important: most Americans have fixed-rate mortgages, meaning their payments are locked in regardless of where market rates go. Keep that in mind—it’s part of why home sellers often don’t understand how mortgage rates affect the valuation of their homes.

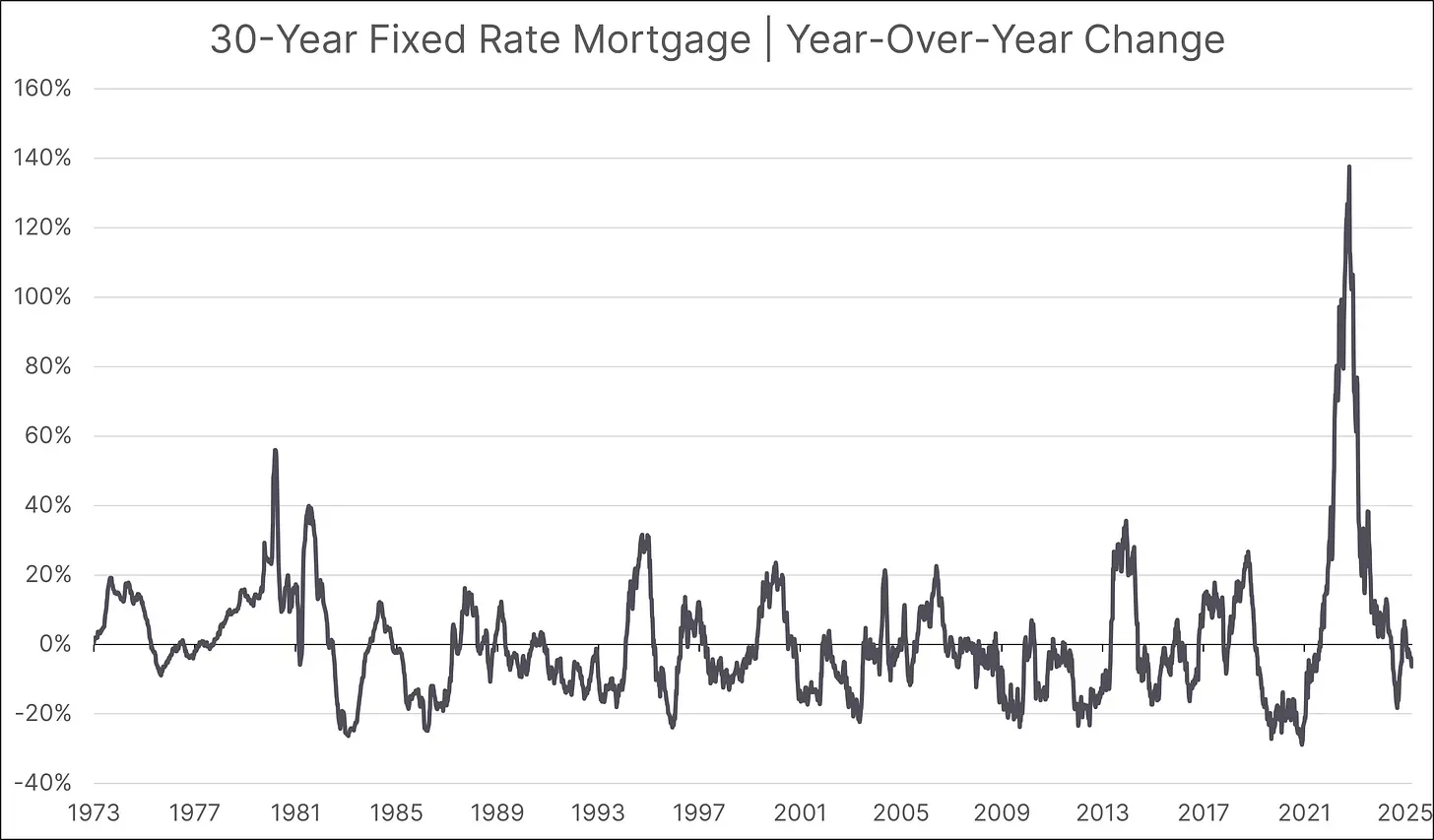

An Unprecedented Movement

Now look at the chart above, which dates back to 1973. We’ve literally never seen a movement in mortgage rates like the one we recently experienced.

Since 1981, mortgage rates have mostly been in decline—falling from a high of 18% to a nearly unfathomable low of 2.65%.

This means that for most Americans, declining rates are all they’ve ever known. And while rates falling below 3% felt great, it was always a mathematical dead end. Unless we believe interest rates can go negative forever (they can’t), the era of falling rates had to end.

There’s no universal law that says mortgage rates must keep falling, and there’s no universal law that says home prices must keep rising.

And yet, for the past 40 years, that’s exactly what people have seen. So it became the expectation—even if it wasn’t grounded in reality.

The Historic Reversal

Not only has this trend reversed, but the reversal itself has been unprecedented.

Before the current cycle, the sharpest year-over-year jump in mortgage rates came in 1980, when rates rose 56%. That’s very similar to our earlier examples. For context, a 56% increase in rates led to monthly mortgage payments rising 28.8%.

Naturally, this made homes less affordable.

But that 56% increase? It pales in comparison to what happened in 2022—when mortgage rates rose 137.6% year-over-year.

Let’s say that again: 137.6%.

That should have translated to a 76.2% increase in monthly mortgage payments. But it didn’t—because most Americans weren’t affected, as they already had fixed-rate mortgages.

The people who did feel it? Prospective buyers.

The Path Forward

Unless we see unprecedented wage growth or mortgage rates fall dramatically, the only path to restoring affordability is lower home prices.

And that’s exactly what we’re seeing from the sellers who understand this—homebuilders.

The average home seller, though, still doesn’t grasp that rising mortgage rates mean their home’s price needs to adjust downward if they want to attract buyers.

The Reality Check

We’ll end on this note: Even if mortgage rates drop significantly in 2025, it will likely be due to a recession—which presents another set of problems for sellers.

If you’re struggling to sell your home, it’s probably because people are struggling to afford it.

The only lever you truly control is price—and thanks to mortgage rates, that’s the lever you may need to pull.